New Home Owner Loans

Regulated by the FCA

By continuing you agree to our Privacy Policy and to be contacted by one of our mortgage experts.

Your home may be repossessed if you do not keep up repayments on your mortgage. Mortgageable is a mortgage broker, and not a lender.

What is a Secured Loan?

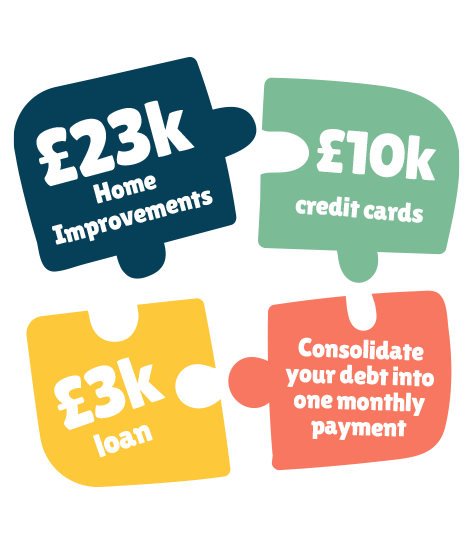

A secured loan, often referred to as a homeowner loans or 2nd charge mortgages, allow you to borrow large sums of money – typically more than £10,000 – using your home as collateral. Therefore, if you don’t keep up with the regular payments, the lender can take possession of your home and sell it to recoup their losses.

The amount you are eligible to borrow, the duration of the loan, and the interest rate you are offered will depend on your circumstances, as well as the amount of ‘free’ equity you have in your home. ‘Free’ equity is the difference between the value on your home and the amount left to pay on your mortgage if you have one. The interest can be variable or fixed depending on the type of loan you choose.

Why Secured Loan?

Best Rates

By using your property as collateral you’re able to access much lower interest rates than a personal loan.

Higher Lending

Depending on the equity in your property, secured loans can let you borrow significantly more than an unsecured loan.

Property as collateral

Because your property is used as a guarantee it’s important to keep up with repayments. Missing them could put your property at risk.

Longer repayment terms

Secured loans can offer longer repayment terms, making them a great option for larger loans.

Secured Loans Questions.

We are now available to help clients with poor or bad credit secure a loan. To check your eligibility for a low-interest secured loan, complete our quick form above and one of our experienced team members will call you. Below, you’ll find answers to the most frequently asked questions about secured loans.

Personal loans and secured loans are completely different forms of borrowing. With a secured loan the debt is linked to your asset (usually the home). A personal loan, also known as an unsecured loan, is not protected by collateral, therefore if you are late with payments or default, your lender cannot automatically take your property, but can go through other methods to reclaim the debt, such as going through the courts.

You don’t need to be a homeowner to be eligible for a personal unsecured loan, but you do need to have a fair credit score. You borrow from a lender or bank and agree to make regular payments until the debt is paid off. As the loan is unsecured, the interest rates tend to be higher than with a secured loan, and you may incur extra charges or fees if you miss payments. This can negatively affect your credit rating, making it more difficult to successfully apply for an unsecured loan in the future.

The two main types of unsecured loans are opening a line of credit, such as credit cards or store cards, and fixed-interest instalment loans such as personal loans, student loans, etc.

Speak to an expert.

Unsure which mortgage is best for you? Struggling to understand the rates? Book a call with one of our experts.