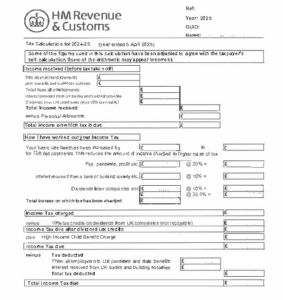

SA302 Example

As HMRC continually develop, sometimes the SA302 form may change ever so slightly either within the layout or the terminology used for headers for example.

What is an SA302 Form?

An SA302 is a document created by HMRC that is commonly required for those who are self-employed in order to prove their income when submitting a mortgage application.

The document provides an overview of an individual’s tax calculation, containing details of all taxable income streams and tax liability.

Each SA302 form covers one financial year and therefore should the potential lender require proof of income for more than one year, further forms will need to be requested.

While SA302 documents are generally required by self-employed people, those who are employed and therefore receive PAYE income but also have other income streams may also require an SA302 form to clarify their total annual income figures to a potential lender.

There is strict legislation within the UK that lenders must abide by, including the requirement of obtaining proof of income from mortgage applicants in order to review an applicant’s suitability and affordability for the chosen financial product. Obtaining and submitting SA302 forms is one method of proving income.

Your tax calculation (SA302) shows:

- Your total income on which tax is due

- Any allowances and relief you have

- The total amount you owe for the tax year

- How HM Revenue and Customs (HMRC) has worked out the amount you owe

It does not include any:

- Payments on account (payments towards your next bill) you have made

- Payments you have made into a Budget Payment Plan

- Other outstanding amounts (such as unpaid tax or penalties)

The SA302 document is also known as a Tax Calculation Form and is often the easiest way for a self-employed person to prove their income, as most lenders accept the documents.

As with any big financial decision, it is highly recommended that independent financial advice is sought ahead of committing to a specific option

How Can I Obtain my SA302?

HMRC have phased out issuing SA302 forms automatically and therefore a request would need to be submitted in order to obtain the documents via:

- Downloading a copy online – The quickest and easiest method of obtaining your SA302 form is to download a copy from the HMRC website. To do this, navigate to your HRMC online self-assessment account and log in. Once logged in select ‘more self-assessment details’, then ‘get your SA302 tax calculation’.

Up to 4 years’ worth of SA302 forms is available via the HMRC website if the person has been self-employed for the duration of this period and submitted annual self-assessments. - Calling to request a copy – The documents can be requested via the telephone, however, please note that it can take up to two weeks for the copies to be received via post.

- Requesting a copy via your accountant – If you have an accountant, they can produce a summary of annual earnings via their commercial accounting software which is also used to perform the self-assessment tax return itself on the person’s behalf. The accountant would need to certify the summary document in order for the paperwork to be accepted by a potential lender.

It is important to be aware that the timing of the document request will be vital in relation to the mortgage application.

The document must contain the relevant financial year’s figures as required by the potential lender and therefore is also linked to the annual self-assessment submission deadlines to ensure that the relevant year’s details have been captured.

Often lenders will require SA302 forms to be dated within 18 months of an application, and up to four years’ worth of documents.

Therefore, to avoid any delays during the processing of any mortgage application, it is worth checking how many years’ worth of proof of income is required for the underwriting process for the potential lender.

Some lenders may also require additional information to prove income such as assigned business accounts, and therefore it is also worth clarifying the requirements ahead of making an application.

It is also important to check the details included on an SA302 for any discrepancies before submitting them to any potential lenders as sometimes there are differences between the figures of the tax due on the Tax Calculation and the Tax Year Overview, which should match.

If you find any discrepancies, highlight these either via your accountant or with HMRC in the first instance.

Related guides:

SA302 Example Summary

In this guide, we have reviewed what an SA302 document is, what information the form contains, the purpose of the document and the process of obtaining an SA302.

We have also discussed the legislative reasons why lenders require specific documents that prove an applicant’s income levels as part of the mortgage underwriting process.

Should you require any further assistance in submitting a mortgage application or proving your income, please contact us to arrange a consultation with our expert team of brokers.

Popular articles:

- How to buy someone out of a house UK

- sa302 example

- Disadvantages of paying off a mortgage earlier

- Owning your house and wanting to buy a second home explained

- How long to sell a house UK

As a specialised mortgage broker, we can also provide advice on the best approach to take as a self-employed person seeking a mortgage or re-mortgage, tailored for your personal circumstances, investigating the suitability of specific financial products ahead of making any applications, in order to protect the applicant’s credit score and ease the stress of the mortgage application process.

As with any big financial decision, it is highly recommended that independent financial advice is sought ahead of committing to a specific option, to ensure that all terms are fully understood, the option is the most favourable for the applicant and that the repayments can be made comfortably.

In addition, it is important to note that with any secured lending, the ultimate consequence of defaulting on the mortgage could mean that the property is repossessed by the lender.

Call us today on 0333o 90 60 30 or feel free to contact us. One of our advisors will be happy to talk through all of your options with you.