You’ll have various options when taking out a mortgage, including whether to be charged a fixed or variable interest rate on the amount you borrow.

One can be better than the other, depending on your circumstances.

This guide compares variable vs fixed mortgages in the UK to help you determine the right option.

What Is a Fixed-Rate Mortgage?

A fixed-rate mortgage offers a fixed interest rate for a certain period, and you’re guaranteed to pay the same amount every month.

Most fixed-rate mortgages involve two-year and five-year deals but can also last up to 10 years or longer, depending on the lender and the product you choose.

When the fixed-rate period ends, you’ll automatically move to the lender’s standard variable rate (SVR) unless you remortgage to a new deal.

The SVR can involve considerably higher rates than the rate you were paying in the fixed term.

Benefits of a Fixed Mortgage

The main advantage of fixed mortgages is they give you certainty.

You know how much you’ll pay monthly for a set period since you’ve locked in the rate.

The fixed rate doesn’t change during the agreed period and will not be affected by changes in the bank of England’s base rate.

With rising interest rates and inflation, a fixed-rate mortgage can be more attractive as it guarantees you’ll pay the same monthly without worrying about unexpected changes.

Drawbacks of a Fixed Mortgage

Since the rate you pay doesn’t change, you risk missing out on potential reductions in interest rates and lower repayments.

If rates fall during the fixed term of the deal, you’ll continue paying more than necessary for months or years.

If you want to exit to a cheaper deal during the fixed term, you may have to pay early repayment charges, which can be very expensive.

What Is a Variable Rate Mortgage?

With variable-rate mortgages, the interest rate can change over time.

The rate you pay and the monthly repayments can go up or down, and different lenders can base such changes on different measures.

How and when it changes can depend on the type of variable rate mortgage you choose.

These include:

- Tracker Mortgage Rate – A tracker mortgage tracks the base rate of the Bank of England and always remains at a specified percentage point above the base rate. When the base rate increases, the tracker mortgage rate rises, and when it falls, the tracker rate decreases.

- Standard Variable Rate – The standard variable rate is the lender’s default rate. Each lender works out their SVR differently and is almost always higher than any of their other offers. It’s not tied to the Bank of England base rate, but it can reflect changes in the base rate, and the lender can change it at any time.

- Discounted Variable Rate – With a discounted rate, your interest rate will be at a set percentage below the lender’s SVR for a set period. For example, if the lender’s SVR is 5% and your mortgage runs at a 2% discount, you’ll get an interest rate of 2%. The discounted rate can run for two to five years, and you may pay a penalty if you wish to switch or pay off your mortgage within that time.

Benefits of Variable Rate Mortgages

A potential advantage of variable-rate mortgages is the rate can go down since the interest rate is not set.

You can pay less for a mortgage than you would with a fixed deal and save money over time.

Variable-rate mortgages are also less likely to have early repayment charges, making it cheaper to switch your deal or pay off your mortgage entirely.

Drawbacks of Variable Rate Mortgages

The main disadvantage of variable rate mortgages is that they can go up at any time, making it more difficult to anticipate what you’ll pay and budget.

They usually involve higher rates than fixed deals, and you could make much higher mortgage repayments.

Most lenders pace certain collars on variable-rate mortgages to ensure the interest rate can’t fall below a certain percentage.

For example, if the collar is 1% and the interest rates fall to 0%, you’ll still pay 1%.

Are Variable Mortgages Better Than Fixed Mortgages?

The type of mortgage best suited for you will depend on your financial situation and how much risk you’re able and willing to take.

If you can’t afford the risk of your mortgage going beyond a certain amount, a fixed mortgage can provide you with more security.

However, if your finances can accommodate a rise in mortgage repayments, a competitive variable-rate mortgage can allow you to take advantage of low initial interest rates while offering the potential for reduced monthly payments if interest rates fall.

Taking current interest rates into account can help you decide whether or not you should fix your mortgage and for how long.

With inflation peaking at the end of 2022, thanks to increases in food and energy prices, the Bank of England base rate will likely go up to try and control the inflation levels.

Therefore, it’s an excellent time to fix your mortgage for two or five years and lock in a lower rate.

The low rate will be guaranteed, and your monthly payments will not change even when interest rates rise.

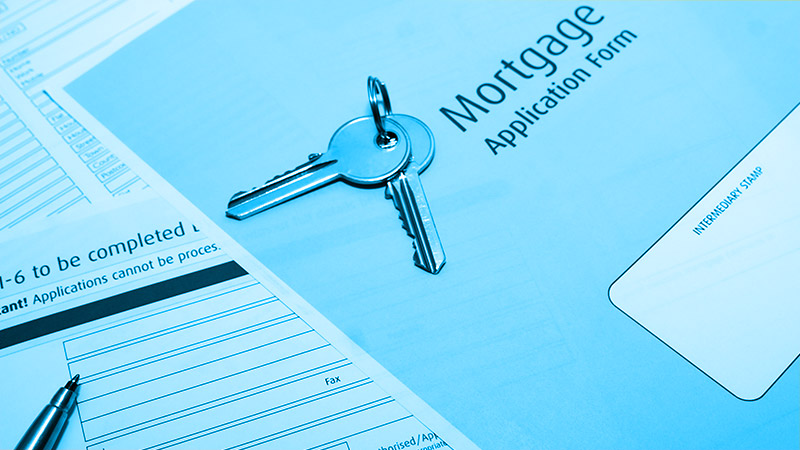

How Do Costs of Variable Vs Fixed Mortgages Compare?

Most fixed-rate mortgages feature an upfront fee which can be called an arrangement fee, product fee, or completion fee.

They can range from £500 to £1,999, so you can’t afford to disregard them in your mortgage calculations.

You must also factor in the early repayment charge if you intend to repay early or make overpayments.

Sometimes the fee can make variable-rate deals more attractive since they may not have product fees or early repayment charges.

However, the rate can be much higher, and it can be worth paying the product fee for a fixed-rate deal, especially if you don’t intend on making overpayments.

Variable vs Fixed Mortgages Final Thoughts

Your circumstances and attitude toward risk will ultimately dictate the right type of mortgage for you.

A mortgage advisor or broker with experience in both mortgage types can provide bespoke advice on whether a variable or fixed mortgage is appropriate for your situation.

Call us today on 01925 906 210 or contact us. One of our advisors can talk through all of your options with you.