Get The Best

Secured Loan Rates

Regulated by the FCA

By continuing you agree to our Privacy Policy and to be contacted by one of our mortgage experts.

Your home may be repossessed if you do not keep up repayments on your mortgage. Mortgageable is a mortgage broker, and not a lender.

What is a Secured Loan?

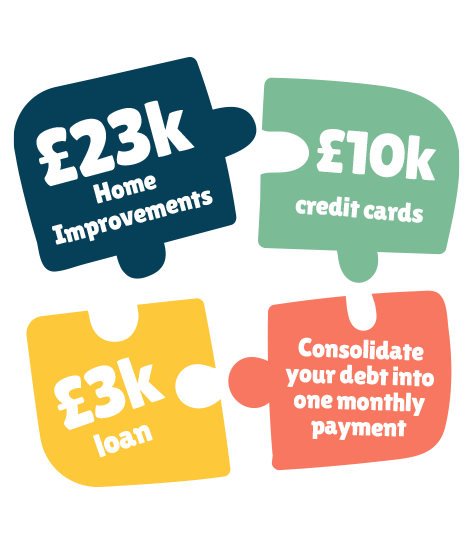

If you need to raise funds—whether for home improvements or to consolidate other debts—you might consider a secured homeowner loan, sometimes called a “personal secured loan” or a “second charge mortgage.”

This type of loan is secured against your home, running alongside but separately from your existing mortgage. A secured homeowner loan can be a smart option if your circumstances have changed and remortgaging isn’t ideal.

When you take out a homeowner secured loan, you borrow a lump sum of cash against your home and repay it in monthly instalments (including interest) over an agreed number of years.

Why Secured Loan?

Best Rates

By using your property as collateral you’re able to access much lower interest rates than a personal loan.

Higher Lending

Depending on the equity in your property, secured loans can let you borrow significantly more than an unsecured loan.

Property as collateral

Because your property is used as a guarantee it’s important to keep up with repayments. Missing them could put your property at risk.

Longer repayment terms

Secured loans can offer longer repayment terms, making them a great option for larger loans.

Secured Loans Questions.

We are now available to help clients with poor or bad credit secure a loan. To check your eligibility for a low-interest secured loan, complete our quick form above and one of our experienced team members will call you. Below, you’ll find answers to the most frequently asked questions about secured loans.

A secured loan is a long-term borrowing option that requires collateral as security for the lender. If you need to borrow a substantial amount over an extended period, a secured or homeowner loan could be a good fit. These loans generally offer lower interest rates compared to unsecured options like personal loans, but they do come with the risk of losing your home if payments are not kept up. However, secured credit also offers several advantages, including higher borrowing limits, flexible repayment terms, broader availability, and lower interest rates.

Speak to an expert.

Unsure which mortgage is best for you? Struggling to understand the rates? Book a call with one of our experts.

Mortgageable does not arrange or advise on Second Charge Mortgages. Your details will be passed to a suitable, regulated firm who will be in touch to discuss your requirements. We will receive a commission from a product or service provider once you receive your product or service, which does not alter the price you pay.

As a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments. Think carefully before securing other debts against your home

If you are thinking of consolidating existing borrowing you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.