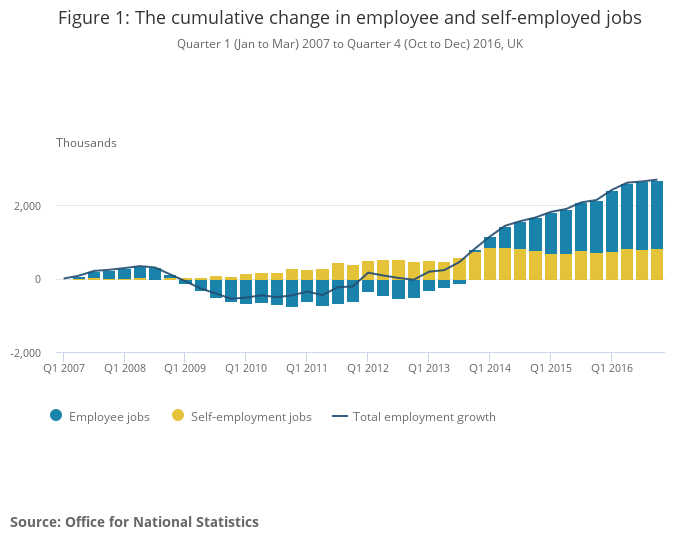

The number of people in self-employment has risen sharply in recent years.

As the number of self-employed borrowers has grown, so has the difficulty in getting a mortgage offer.

We’re not going to lie to you, there are a few hoops to jump through if you want to get onto the property ladder.

It’s important to get all of your ducks in a row before you begin looking for the right mortgage. But don’t worry, all the planning will pay off.

What counts as being self-employed?

Lenders may class you as self-employed if you own around 25% of a business or more.

If you are in a partnership or are a sole trader, your lender will view you as being self-employed.

How to get a mortgage Self Employed

Can you definitely get a mortgage if you’re self-employed?

Yes, but you’ll need to meet the following criteria first.

Typically you will need to have at least two years’ worth of accounts or self-assessment tax returns available to show to your lender. In some cases, you might need to provide up to three years’ worth.

You may find that some lenders are stricter than others, too. Some might want to see a projection of your future earnings in the form of upcoming contracts, while others will be happy with just one year’s worth of accounts.

As a general rule, lenders are simply looking for evidence of reliable earnings and regular records of your income. Crucially, they need to be confident that you can sustain your current level of income in the years to come.

Self employed mortgage without proof of income

No matter your situation, lenders will always require you to provide proof of income as part of the mortgage application.

This is essential since lenders will want to a mortgage applicants affordability, which needs to be recorded.

Therefore, the answer is that you will have to present proof of income. Interestingly, in recent years there has been a move to request proof of income directly from HMRC, so you may not always be asked directly to provide proof.

However, this is by no means standard practice, but it is becoming more common as it helps lenders save a considerable amount of time when assessing mortgage applications.

The good news is that as mortgage brokers, we are well versed in how to document proof of income prior to application submission.

Self Cert Mortgages – are they the same thing?

For many years, a type of mortgage referred to as a self-cert mortgage was available for the self-employed, it was later opened up to other individuals who had complex incomes.

Self-cert mortgages were at incredibly popular and many people took advantage of the scheme, however, the financial regulator soon decided that they were too risky and the rate of defaults was too high, therefore they were officially axed.

As a result, self-cert mortgages are no longer available in the UK.

How much can you borrow with a self-employed mortgage?

Mortgage lenders do not all assess personal income the same way and as a result, they can come to different income figures.

For example, some lenders may base it on your most recent annual income, while others may base it on an average of the past few years.

They may also consider and apply a different weight to your direct income, salary, dividends and other investments you may have.

Ultimately, there is no one main method that lenders use across the board to conclude your personal income. Although, the good news is that once that figure has been determined, they will use the rules they apply to everyone else that applies for a mortgage through them.

Getting a Self Employed Mortgage

There are plenty of things that you can do to make yourself look more attractive to lenders. Here’s what we’d suggest if you’re planning to make that first step onto the property ladder.

- Employ a chartered or certified accountant. Most lenders will insist that your accounts are prepared by an accountant. There is also the added bonus that you won’t have to do your own accounts anymore!

- Avoid spending on “red flags”. Things like online gambling websites and payday loan companies are big red flags for most lenders. Steer clear of these.

- Enlist the help of a mortgage broker. This is one of the best things you can do when you are self-employed and looking for a mortgage. A broker will be able to point you in the direction of the lenders that are most likely to give you a good rate, saving you a lot of time and money.

Self Employed Mortgage Broker – I want to Speak to Someone?

Now that you fit all of the criteria above, it’s time to start looking for a mortgage.

If you’re self-employed and ready to buy your first home, you probably have a tonne of questions.

Get in touch and we can walk you through the process, helping to find the right lender for you.

Alternatively, complete our simple application form here and we’ll be in touch.