Small Secured Loans

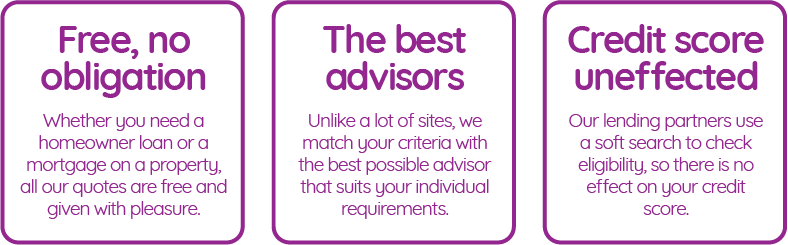

We specialise in small secured loans. Simply complete the quick application form below and our team will search over 400 loans with exclusive rates for homeowners.

Please enter and select your address.

A secured loan is a way to borrow money against an asset you own, such as a car or a house. They are often used by those who require a large or long term loan or are unable to get approval for a personal loan. Those considering a secured loan should know that they come with the risk of losing your assets, which could be life-altering. This article will give you all the facts you need about secured loans, so you can make an informed decision on whether it is the right option for you.

What is a Homeowner Loan?

A secured loan, often referred to as a homeowner loans or 2nd charge mortgages, allow you to borrow large sums of money – typically more than £10,000 – using your home as collateral. Therefore, if you don’t keep up with the regular payments, the lender can take possession of your home and sell it to recoup their losses.

The amount you are eligible to borrow, the duration of the loan, and the interest rate you are offered will depend on your circumstances, as well as the amount of ‘free’ equity you have in your home. ‘Free’ equity is the difference between the value on your home and the amount left to pay on your mortgage if you have one. The interest can be variable or fixed depending on the type of loan you choose.

Difference between Personal and Secured Loans

Personal loans and secured loans are completely different forms of borrowing. With a secured loan the debt is linked to your asset (usually the home). A personal loan, also known as an unsecured loan, is not protected by collateral, therefore if you are late with payments or default, your lender cannot automatically take your property, but can go through other methods to reclaim the debt, such as going through the courts.

You don’t need to be a homeowner to be eligible for a personal unsecured loan, but you do need to have a fair credit score. You borrow from a lender or bank and agree to make regular payments until the debt is paid off. As the loan is unsecured, the interest rates tend to be higher than with a secured loan, and you may incur extra charges or fees if you miss payments. This can negatively affect your credit rating, making it more difficult to successfully apply for an unsecured loan in the future.

The two main types of unsecured loans are opening a line of credit, such as credit cards or store cards, and fixed-interest instalment loans such as personal loans, student loans, etc.

Who is a Secured Loan Suitable for?

Typically, a secured loan is for those that have a poor credit rating or no credit history, which makes them ineligible for a personal loan. The main condition is that you are a mortgage holder or homeowner that has enough equity in their home to act as security for the loan. Also if you are tied in on your current mortgage with your lender and wish to avoid paying early repayment charges to switch lenders as an alternative to a further advance a secured loan may be available to you to borrow additional funds.

Homeowner Loans Bad Credit – Are they Suitable?

If you have bad credit, we can help you to secure a homeowner loan. The bad credit issues we will consider include:

- Late payments and defaults

- Low credit score or no credit history

- Mortgage arrears

- Debt management plans

- County Court Judgements (CCJs)

- Individual voluntary arrangement (IVA)

- Repossession

- Bankruptcy

If you would like more information on bad credit secured loans, get in touch with one of our loan experts today.

Typical Eligibility Requirements for a Secured Loan

Although the main requirement for a secured loan is home ownership, there are other eligibility requirements that secured loan providers may expect you to meet. They will vary between lenders, but will typically include:

A Steady Income

Loan providers will want to know that you can afford the monthly payments and will need to see evidence of a steady income. The majority of providers will have a minimum salary requirement that must cover your monthly payments and any other outgoings you have. There are some secured loan providers that specialise in lending to the self-employed that can’t show a steady income. You will be required to provide tax returns and bank statements.

A Good Credit Score

Having a good credit score improves your chances of being accepted for a secured loan. Usually, better your credit score, the more you will be eligible to borrow and the better the interest rate you will be offered. However, as previously mentioned, you are not ruled out if you have a bad credit rating, as your home serves as collateral, but you may have to pay higher rates of interest.

Property

With a secured loan, usually the home is used as collateral. If you still have a mortgage on your home, your loan will be known as a second charge mortgage. This means that if you don’t keep up with payments and your home is repossessed, your first mortgage lender has the first priority to take what is outstanding. The second charge lender then has the second chance to claim the debt. If you don’t have a mortgage, your secured loan will usually be referred to as a first charge mortgage.

‘Free’ Equity

Secured loan providers will usually require a certain amount of ‘free’ equity in your home. The majority of lenders will have a cap of the total debt secured against your home. Generally speaking, the higher the amount of ‘free’ equity you have in your home, the more you will be able to borrow.

Your Age

There is typically and upper and lower age limit on secured loans. These will vary between lenders with most lenders accepting applicants between 18 and 21 years old, up to between 70 and 80 years old.

What Might you use a Secure Loan for?

There are a number of reasons why you may be considering a secured loan, as you have the potential to borrow large sums of money. You could use a secure loan for any legal purpose such as the following:

- Home improvements, necessary repairs, and light refurbishments or extensions.

- To raise the deposit needed to purchase a second property.

- To consolidate any other significant debts into one monthly payment with a lower interest rate.

- Repay loans on government-funded schemes, such as help-to-buy.

- For a capital injection into your business, for the likes of expansion, updating equipment, etc.

- Any other reasonable costs, such as weddings, education costs, etc.

A Secured Loan for Consolidating Debts

There are a number of benefits of using a secured loan to consolidate your debts, which include:

- Easier Budgeting – Instead of having to juggle multiple monthly payments and keeping track of a number of balances, and various payment dates, you will just have one monthly payment that comes out on the same day every month.

- Better Understanding of your Debt – With just one monthly payment and just one debt, you will know at a glance how much you owe and how quickly you are paying off the loan. Furthermore, you will only have to keep track of one interest rate, which will make it easier to keep track of any changes.

- Potentially Lower Interest Rates – You could be paying a lot less interest, by paying just one interest, instead of multiple. Just be aware that the longer your loan term is, the more interest you will pay.

Advantages and Disadvantages of a Secured Loan

Take a look at the advantages and the disadvantages of a secured loan, to help you to make a decision if it is the right loan for you.

Advantages

- Ability to Borrow More – With a secured loan you can potentially borrow a lot more money than you can with a secured loan. It can be difficult to borrow more than £25,000 with an unsecured loan, but secured loans can be as high as £100,000 or even more. A loan this size can prove very useful if you have a big renovation or home improvement projects, education costs, or medical bills, etc.

- Lengthier Loan Terms – You tend to be able to get longer loan periods with a secured loan, which can make the monthly payments more affordable than with a unsecured loan.

- Good for Those with Poor Credit – As a secured loan uses your home as collateral, it is lower risk for the lender. This means that it is easier for those with bad credit or no credit history to successfully apply for a secured loan.

Disadvantages

- Larger Risk – An unsecured loan comes with significant risk. If you default on your payments, your lender can repossess your home to recover the debt. You may be able the work out an agreement with your lender by getting in touch with them as soon as you realise you’re having difficulty meeting your monthly payments. Furthermore, any defaults will be recorded on your credit report, which can negatively affect your credit score. This may affect your ability to access loan services in the future.

- Pay More Interest – You do have the benefit of lower monthly payments for a longer term, but this comes with its own disadvantage. As interest is charged monthly, you are likely to pay more interest overall – i.e. the more months of your loan term, the more interest you will pay.

- Early Repayment Fees – If you want to pay the loan off earlier than your agreed loan term to reduce the amount of interest, you may be subject to early repayment fees.

- Broker fees may be higher – a mortgage broker may charge a fee for their services, while a secured loan fee can often be higher than this. Typically, an unsecured personal loan comes with no additional fees (other than interest), so remember to take into consideration that there will be a higher fee for a secured loan.

What to Consider before Applying for a Secured Loan

As a secured loan puts your home at risk, they should not be taken out without knowing everything you can. Before applying, these are things that you should consider:

- Your Financial Status – If you don’t keep up with the monthly payments of a loan, you risk losing your house. Therefore, you should carefully consider what you can afford to pay on a monthly basis, taking into account current and future expenses. If you are not confident that you can make the monthly payments, consider if you can borrow a lower amount or if you even need the loan at all. Speak to one of our secured loan experts who can help you get you to work out what you will be able to afford and the perfect length of the term.

- Loan-to-value Ratio – Your lender will take into account the amount of equity you have in your home, which is the difference between the value of your home and the amount you still owe on your mortgage. This lets your lender know how much money they could recover should you not keep up with your monthly payments. Generally speaking, the more equity you have in your home, the more you will be eligible to borrow.

- Interest Rates – Secured loans tend to have a variable interest rate, so it is important to consider any potential raises in interest when determining what you can afford. Furthermore, when you are looking at secured loans, bear in mind that the advertised interest rate may not necessarily be what you will get. Your actual interest rate will depend on the amount you want to borrow, your loan term, the value of your collateral, and your credit score.

- The Loan Term – The shorter your loan term he higher your monthly payments will be, but the less interest you will pay over the course of the loan. The longer the loan term the lower your monthly payments, but the more interest you will pay. It is important to weight up your options with what you can afford, before deciding the length of your loan.

Fees Involved with Secured Loans

A secured loan is likely to have a higher interest rate than your mortgage, but there will be other fees and charges to pay, which may include:

- Booking Fee – An upfront payment during the application process that usually costs around £100.

- Arrangement Fee – To set up the secured loan, which typically costs £1,000.

- Higher Lending Charge – That will cover a high percentage of the purchase price.

- Legal Fees – Your solicitors fees for arranging the paperwork.

- Broker Fee – If you take advice and go through a mortgage broker.

A secured loan expert will be able to give you more information on the fees that you can expect to pay and when you will need to pay them.

How to Get a Secured Loan

Your first step in getting a secured loan is to approach your existing mortgage provider and see what they can offer you. Your mortgage provider may be able to offer you special rates and deals if you have a good record making your monthly payments with them. Don’t just accept the deal your current lender offers you, take a look at some comparison sites and see what other deals you may be eligible for. Remember to check the terms and conditions of each interesting loan carefully.

If you have read all the information on secured loans carefully and feel that you want to proceed with a secure loan, get in touch with one of our secured loan experts who can work with you to find the best deal for your needs and circumstances.

An Expert.

understand the rates? Book a call with one of our experts.